How to Add a One-Time Earning or Deduction to an Employee's Paycheck

Adding a one-time earning or deduction to an employee's record is a common task in payroll management. This allows you to account for specific additional payments or deductions that are not part of the regular salary or wages.

Here are the steps to add a one-time earning or deduction to an employee:

Enter the earning/deduction to the employee on the time entry grid.

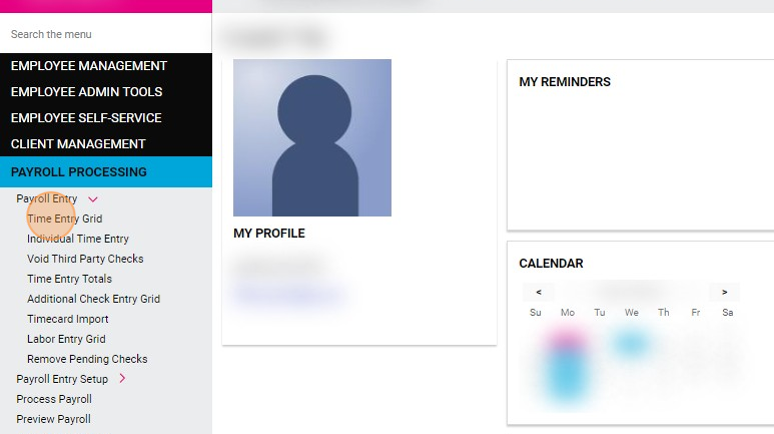

1. Log in to isolved and navigate to "PAYROLL PROCESSING"

2. Click "Payroll Entry" > "Time Entry Grid"

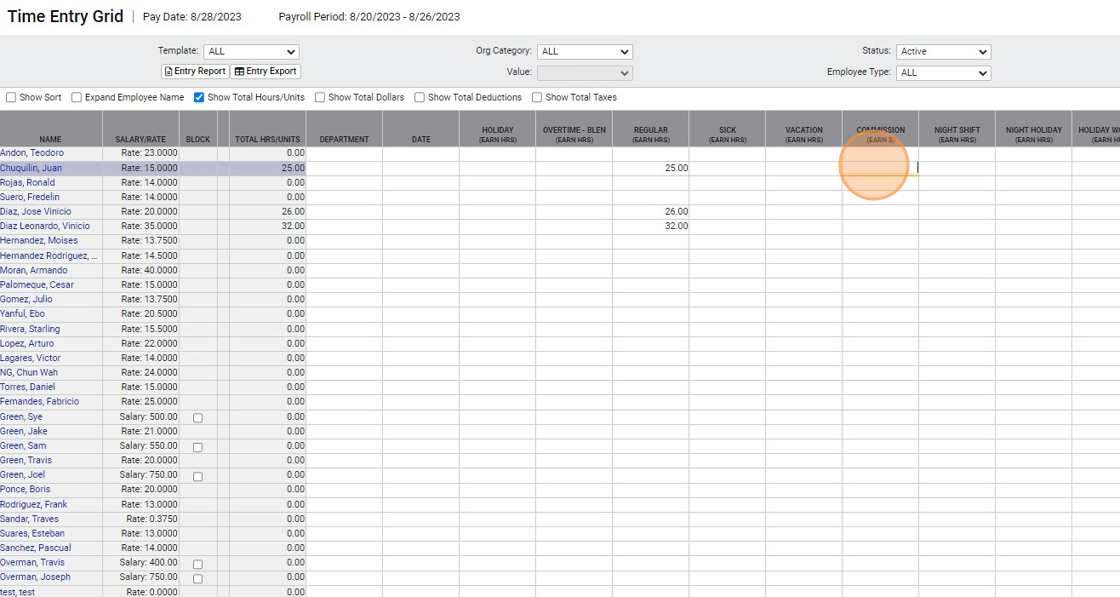

3. Select "ALL" from the Template dropdown.

The default template will generally show just the common earning types that are used with every pay period. To display additional earnings, you have to choose all from the dropdown.

4. Click "Apply"

5. Select the cell for the earning you want to apply and enter the amount or hours

Once you have filled in the required details, the information will be automatically saved.

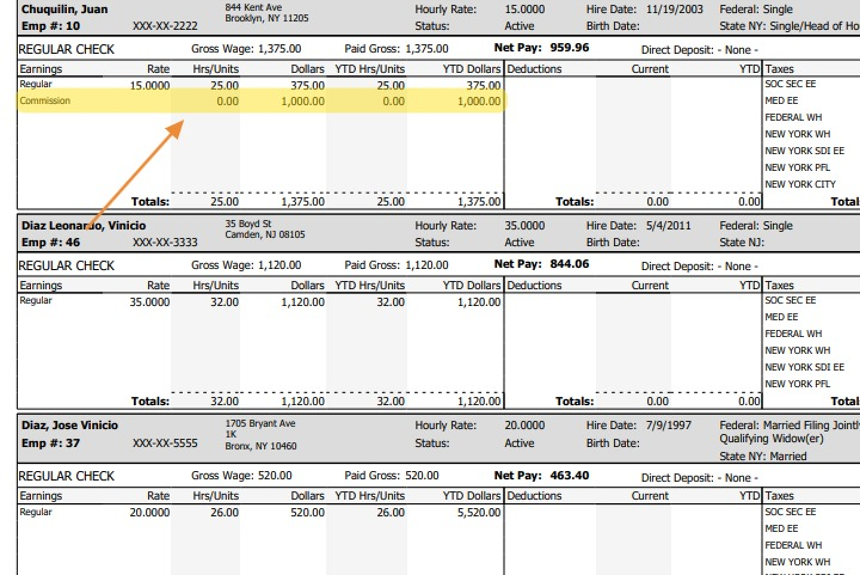

Recommended: Preview the check register

It is highly recommended to take a moment to review the data entered and confirm that the one-time earning or deduction has been added correctly. Check for any discrepancies or errors, and make any necessary adjustments.

To do so, follow these steps:

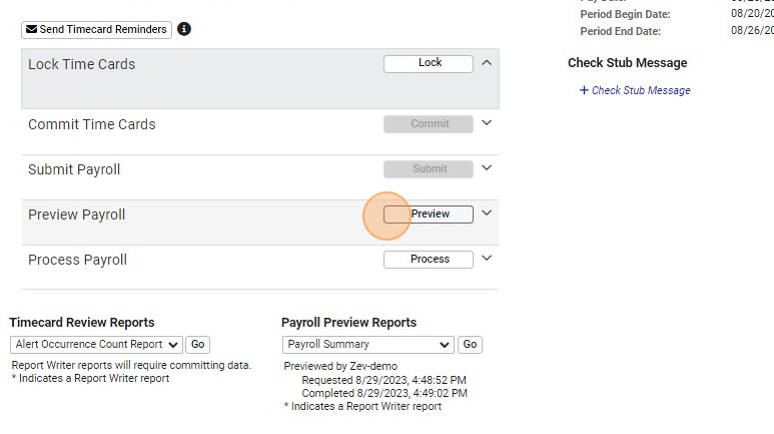

1. Click "Process Payroll"

2. Click "Preview"

3. Select "Payroll Register" dropdown.

4. Click "Go"

5. Verify that the added earning/deduction displays correctly on the employees paycheck.

It's important to inform the employee about the one-time earning or deduction that has been added to their record. This can be done through a direct conversation, email, or a written communication. Provide the employee with clear explanations regarding the reason for the one-time earning or deduction, as well as how it will impact their overall compensation.

Related Articles

How to Add a Missing Punch in isolved Time as an Admin

As an admin using isolved, you have the ability to add a missing punch for an employee. If an employee forgets to clock in or out for a shift, or if there is any other type of missing punch, you can easily correct it in isolved. While administrators ...How to Review Time Cards for Payroll Processing

Payroll processing is a critical function for any organization, and accuracy is paramount to ensure that employees are paid correctly and on time. Reviewing time cards is a crucial step in this process to ensure accuracy before processing payroll. In ...How to Modify Time Cards in isolved After the Pay Period Was Closed

Sometimes employers become aware of time cards errors or omissions after the pay period was already closed and payroll has been processed. While employees can be made whole by adding the missed hours to the next payroll run, or by issuing a special ...How To Complete The Employee Onboarding Process

This guide provides a straightforward and efficient walkthrough for completing the employee onboarding process using the PayWhiz platform. It simplifies the steps involved, ensuring that HR professionals can easily navigate through the necessary ...How to Initiate Electronic Employee Onboarding

Employee onboarding in payroll refers to the processes used to set up new employees in an organization's payroll system. This may include collecting employee contact and bank information, filling out tax forms, and signing the company handbook. ...